01

Enhanced Member Insights

Gain valuable perspectives on member needs and preferences.

Harness the power of big data and AI to unlock a deeper understanding of member behavior, anticipate future needs and deliver personalized experiences that drive engagement and loyalty.

Fill out the form to access powerful analytics that drive better decisions and results!

Gain deeper insights into member behavior and preferences with AI-powered analytics. Rise Analytics helps credit unions segment members, predict needs, and personalize engagement—driving loyalty and long-term growth.

How Member Insights Helps You:

Understand member needs and preferences in real time.

Segment members based on behavior for personalized marketing.

Identify high-value members and predict lifetime value.

Proactively improve retention with AI-powered insights.

Leverage advanced AI and predictive analytics to track member behaviors, preferences, and interactions in real time. With custom dashboards, automated alerts, and data-driven segmentation, you can deliver personalized experiences, improve retention, and enhance engagement effortlessly.

What You Get with Member Insights

Member Segmentation AI

Member Retention AI

Next Best Product AI

Member Lifetime Value AI

Next Best Action AI

Member Risk Score AI

New Member Acquisition AI

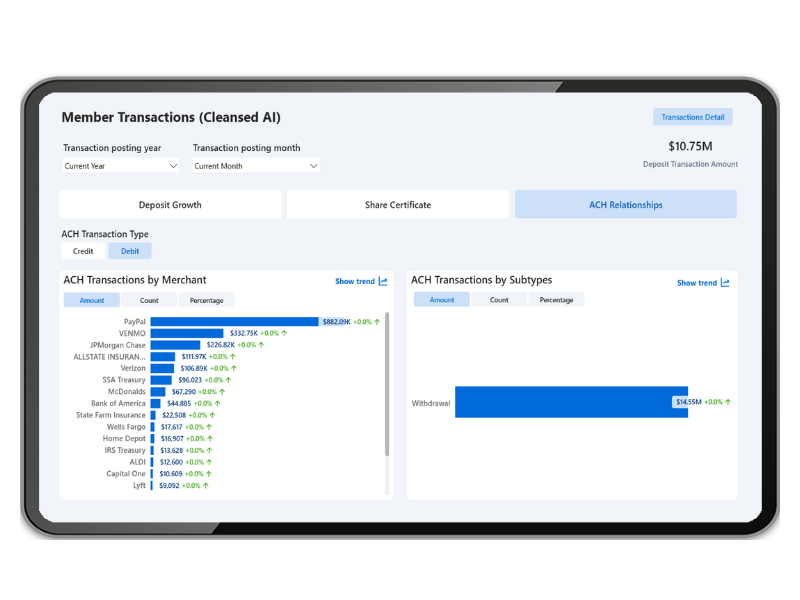

With Rise Analytics’ Transaction Enrichment AI, you can transform member transaction data from difficult to decipher letters and numbers into clear business names, allowing you to gain insights into member spending behavior and how money is leaving your credit union.

Transaction Enrichment AI Helps You:

Create clean, easy to read reports of member transactions

Identify members who have accounts with other financial institutions

Promotes cross-selling opportunities

Enables trigger-based marketing opportunities

Click here for more details.

Fill out the form to access powerful analytics that drive better decisions and results!

Gain valuable perspectives on member needs and preferences.

Categorize members effectively based on their actions.

Strengthen relationships through personalized interactions.

Predict and address potential member churn.

"Through Rise’s insights, we are able to launch targeted financial wellness campaigns and design lending solutions that balances risk with opportunity. As a result, we expect to see increased member engagement, improved credit outcomes, and a meaningful uptick in loan growth from this segment. Rise didn’t just help us serve these members—they helped us empower them." Our mission statement is “Empower our communities to improve their financial lives – that’s our Main thing!”

Ron Hendrickson

SVP/Chief Lending Officer

Mainstreet Credit Union

“This is certainly my favorite and most data progressive project I have been working on, continuing to get new data incorporated into these types of holistic views will be extremely powerful for CalCoast.”

Kevin Dawson

Digital Marketing Director

California Coast Credit Union

Discover how AI-powered analytics can help your credit union enhance engagement,

predict member behavior, and improve retention.

Fill out the form to access powerful analytics that drive better decisions and results!